In an effort to improve consistency between not-for-profit organizations’ classification of exchange and nonexchange transactions following the release of the new revenue recognition standard, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, on June 21, 2018.

In an effort to improve consistency between not-for-profit organizations’ classification of exchange and nonexchange transactions following the release of the new revenue recognition standard, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, on June 21, 2018.

The FASB received comments asking to clarify when to record a contribution, also known as a nonreciprocal transaction, versus an exchange transaction, also referred to as a reciprocal transaction—specifically as it relates to grants and similar contracts from governmental agencies. A need to clarify when contributions are conditional or restricted also contributed to this update.

This guidance is applicable to all organizations that receive or make contributions—including business enterprises—but it primarily affects not-for-profit organizations, as most depend strictly on contributions and grants. It’s also worth noting the update doesn’t apply to the transfer of assets from governments to businesses.

Key Provisions

Contributions versus Exchange Transactions

To determine if a transaction is a contribution, an organization first needs to evaluate whether the donor or grantor receives commensurate value in return for the contributed resources.

ASU 2018-08 clarifies the public receiving a benefit from contributed resources doesn’t classify as a reciprocal transaction. For example, if the government gives an organization a grant for one of its programs to help low-income families, it would be considered a nonreciprocal transaction because the government isn’t receiving a benefit from the grant. In other words, the public—which in this example is the low-income families—receiving the benefits doesn’t equal value received by the government.

Additionally, if the transfer of assets lines up with a donor’s mission, it doesn’t constitute equal value received for purposes of determining whether a transfer of assets is reciprocal or nonreciprocal. For example, if an organization focused on women’s rights gives money to a foundation that empowers women in a specific location, the money received would be recorded as nonreciprocal even though the grantor is fulfilling its own mission with the grant.

Ultimately, if a donor or grantor receives commensurate value for transferred assets, it would be considered a reciprocal transaction—also known as an exchange transaction. In these cases, FASB Accounting Standards Codification® (ASC) Topic 606, Revenue from Contracts with Customers, offers relevant guidance that would be used to determine when to recognize the revenue.

If a donor doesn’t receive any value, it would be considered a nonreciprocal transaction and deemed a contribution. The contribution would then be recognized in the period received unless it’s conditional.

Conditional versus Unconditional Contributions

The ASU requires organizations to determine whether a contribution is conditional based on whether an agreement includes two items:

- A barrier

- A right of return of assets transferred or a right of release of an obligation to transfer assets

Barrier Indicators

- Performance-related barrier or other measurable barrier, including specific service levels, desired output, or a specific outcome

- The extent to which a stipulation limits a recipient’s ability to choose how it performs an activity by requiring specific guidelines be followed or specific individuals be hired

- Whether a stipulation is related to the purpose of the agreement—a school adding more classrooms to increase the number of students, for example

Why It Matters

The update primarily affects the timing of when revenue is recognized. It’s also expected with the implementation of ASU 2018-08 that more grants and contracts will be accounted for as contributions—and often conditional contributions—than under current guidance. This means that if deemed a contribution, an organization receiving a grant doesn’t need to apply ASC Topic 606 and the disclosures it requires.

It’s worth noting even if a contribution is deemed unconditional, an organization will still need to determine if it’s restricted using ASC Topic 958-605, Not-for-Profit Entities—Revenue Recognition. A donor-imposed restriction specifies how the contribution may be used.

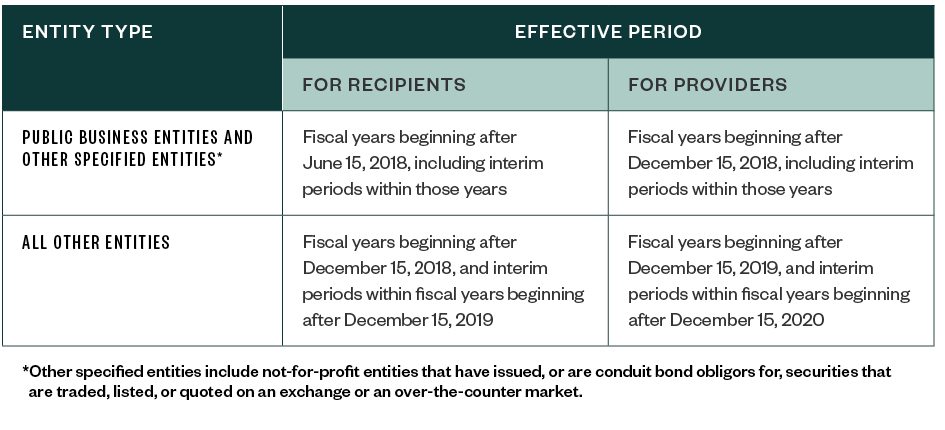

Effective Dates and Transition

Early adoption of the amendments in this update is permitted.

We’re Here to Help

For more information about adopting ASU 2018-08 and how it may affect your organization, contact your Moss Adams professional.